Can Trademark Be Registered In The Name Of Sole Proprietor Firm

How to Start a Sole Proprietorship Registration

Sole Proprietorship Registration - An Overview

As we know, India is i of those countries which is full of people who are managing and operating their business organisation by choosing Sole Proprietorship every bit their business structure. Moreover, this business model requires compliance with very few legal formalities and is suitable for the people who do non have adequate uppercase. Further, sole proprietorship registration is required for the businesses which are owned, managed, and controlled by a single individual, as it will eventually aid them in carrying out business operations with ease and flexibility.

Nowadays, the Sole Proprietorship as a business organization model is more often than not chosen by the micro and small enterprises with less investment, operating in the unorganized sector. Moreover, information technology is too ideal for the embryonic entrepreneurs who desire to start their own concern. Lastly, some of the examples of a sole proprietorship are salons, grocery stores, chemist shops, photo studios, etc.

What is Sole Proprietorship?

The term Sole Proprietorship refers to a business organisation construction that is simplest and easiest to class and likewise requires compliances with minimal legal formalities. Moreover, there is no such formal regulating human activity prescribed for governing the registration of sole proprietorship.

Further, the concept of Sole Proprietorship does non savor the condition of a carve up legal entity, and likewise the ownership of a sole proprietorship firm is not qualified to be transferred to another individual. Hence, the being of the business will come to an end with the expiry of the possessor.

Who is a Sole Proprietor?

A living private who is the owner of the sole proprietorship firm is known as the Sole Proprietor. Moreover, he must be both an Indian citizen and also a resident. Farther, a Sole Proprietor is solely entitled to all the profits earned in the firm and also solely and personally liable to conduct all the losses incurred.

Hence, as per the concept of the Sole Proprietorship, there is no legal dissimilarity between the possessor and business. Furthermore, it shall be relevant to have into consideration that a corporate entity is not eligible to go the Sole Proprietor of the business firm.

Benefits of Sole Proprietorship House Registration

The benefits or the advantages of a Sole Proprietorship Firm is enumerated below:

- The Proprietorship house is not obligated to obtain Compulsory Registration.

- An individual who wants to starting time a sole proprietorship firm can do information technology without following any formalities.

- Another meaning advantage annexed with the concept of sole proprietorship firm is the minimum compliance requirement.

- A Sole Proprietorship firm is not required to become its accounts audited statements with the MCA (Ministry of Corporate Affairs) each year.

- A Sole Proprietor having an income of less than Rs 2 lakhs is not supposed to pay the income tax.

- A single person tin easily start a Sole Proprietorship Firm.

- For the Sole Proprietorship Firm Registration, at that place is no such minimum limit prescribed for the majuscule requirement as information technology depends upon the sole owner and his will.

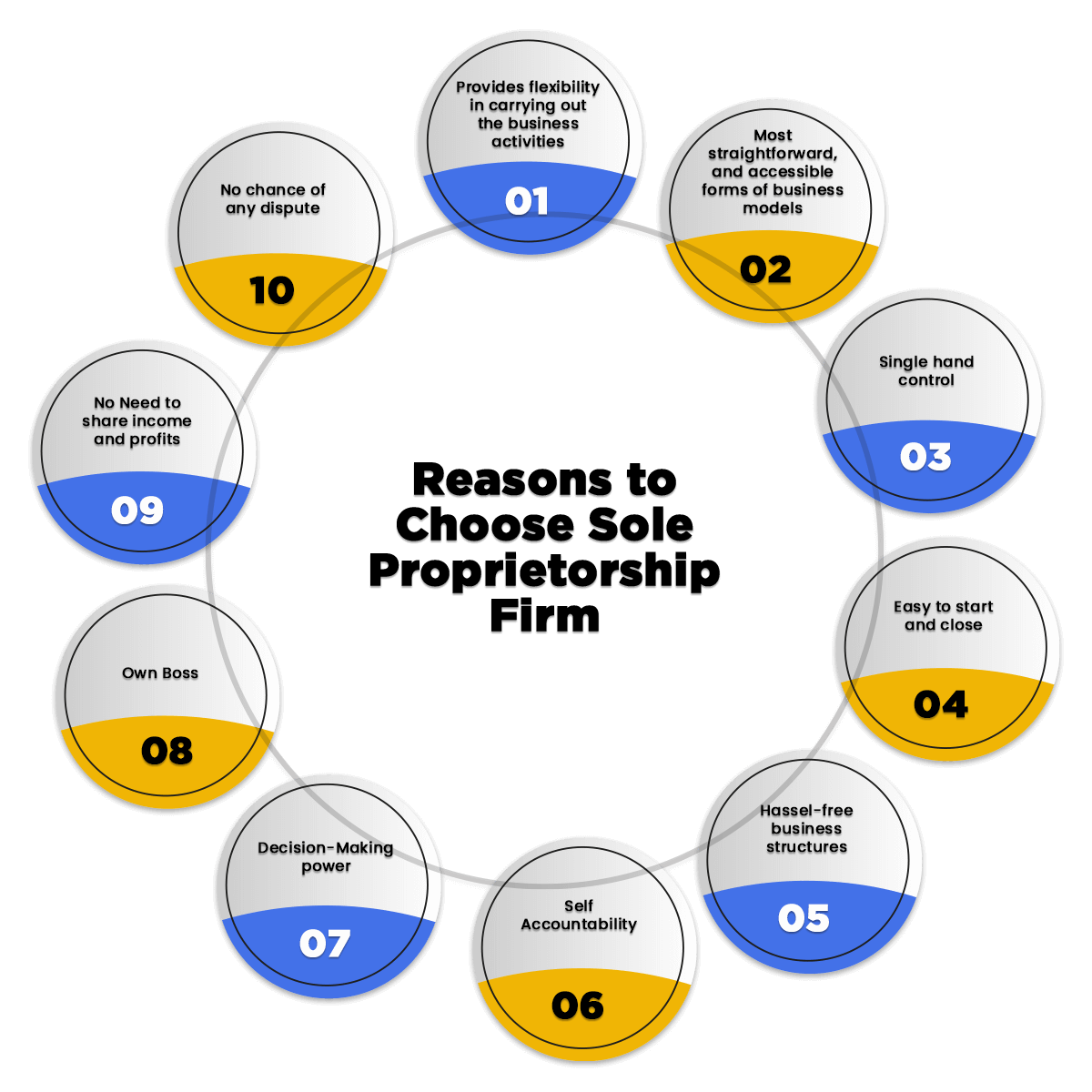

Why should one opt for a Sole Proprietorship House?

The post-obit listed are the reasons as to why should one choose a Sole Proprietorship Firm:

- Provides flexibility in carrying out the business activities

- One of the oldest, nigh straightforward, and most accessible forms of business organization models

- Unmarried hand control

- Easy to start and shut

- Hassel-free business structures, that, too, with very few compliances.

- Self-Accountability

- Owner of the Sole Proprietorship Firm is considered to own dominate. This ways he is not answerable and answerable to whatsoever shareholder and director

- Decision-making ability

- The Sole Owner is not required to share income and profits generated with anyone

- No chance of whatever dispute betwixt the partners or directors or shareholders.

How to Outset a Sole Partnership in India?

In total, there are only two requirements that are to be followed while incorporating or establishing a Sole Proprietorship Firm in Bharat. The post-obit listed are the two requirements that are to be complied with for commencing or setting-upwardly a Sole Proprietorship Business firm:

- Cull a Unique Business organisation Name.

- Choose a Location every bit the place of carrying out business organization.

After fulfilling these two requirements, one tin can legally showtime doing business organisation. Also, Know the Reasons to Apply for Sole Proprietorship Registration.

Documents Required for Sole Proprietorship Registration

The following listed are the documents required for obtaining Sole Proprietorship Registration:

- PAN (Permanent Account Number) Card

- Aadhar Card

- Banking concern Account

- Registered Address Proof

Further, a Sole Proprietorship Firm does non require any specific registration. Still, in lodge to run a business smoothly and with ease, the owner of the business is required to get registered under the following listed:

- GST Registration

- MSME Registration

- Registration under the Shops and Establishment Deed

Other documents required for the registration of sole proprietorship firm are as follows:

- License or the Certificate issued by the Municipal Authorities

- CST (Central Sales Tax) or VAT (Value Added Tax) certificate

- ITR (Income Tax Returns) documents

- Certificate granted past the Sales Tax or Service Tax or Professional Tax authorities

- Certificate allotted by the Food and Drug Control Authorities, IMC (Indian Medical Council)

- IEC (Import Export Lawmaking) allotted to the Sole Proprietor by the office of DGFT (Managing director General of Foreign Trade)

- Utility bills in the grade Water Tax Neb, Electricity Bill and the Landline Telephone Bills issued in the name of the concerned Sole Proprietor.

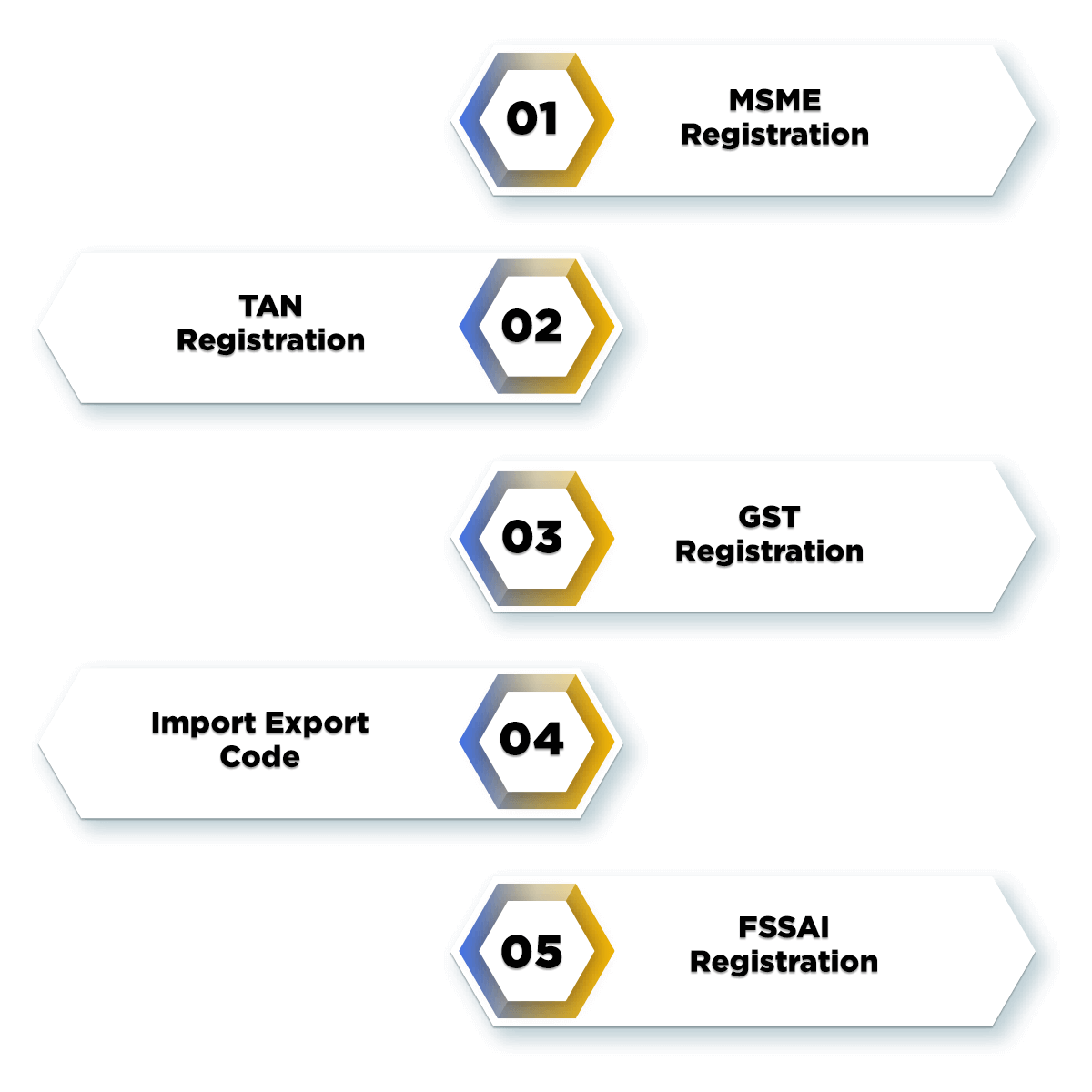

Procedure for Sole Proprietorship Registration

A Sole Proprietorship is formulated by way of various other registrations and licenses. Some of the standard registrations to be followed to obtain a Proprietorship House are equally follows:

- MSME Registration

MSME (Micro Modest and Medium Enterprises) or the Udyog Aadhaar registration can be caused in the name of the business in guild to plant that the concerned Sole Proprietorship firm is registered under the Ministry of Micro, Pocket-size and Medium Enterprises.

- TAN Registration

TAN (Tax Deduction Business relationship Number) Registration should exist obtained for the concerned proprietor from the IT section. Still, the said proprietor is required to obtain TAN Registration only if he or she is making bacon payments in which TDS (Revenue enhancement Deducted at Source) deduction is required.

- GST Registration

GST (Appurtenances and Service Tax) registration should be obtained past the Proprietor, if he or she is selling goods or services that exceed the prescribed threshold of GST turnover for registration.

Further, in most of the states, GST registration is needed for those service providers who are having an annual turnover of more than Rs 20 lakhs, and in the case of traders, the almanac turnover must be more than Rs twoscore lakhs.

- Import Export Code

An Import Export Code (IEC) can exist acquired from the DGFT (Director General of Foreign Trade) in the proper noun of the business organisation. However, the same is possible only in case the said Proprietorship firm is dealing in the export and import of goods into India.

- FSSAI Registration

FSSAI Registration is required merely in the case where the proprietorship house is involved in the business of selling food products or in the treatment of food products. Further, an FSSAI license registration is obtained in the name of the Proprietor from the FSSAI (Food Safety and Standard Potency of Bharat).

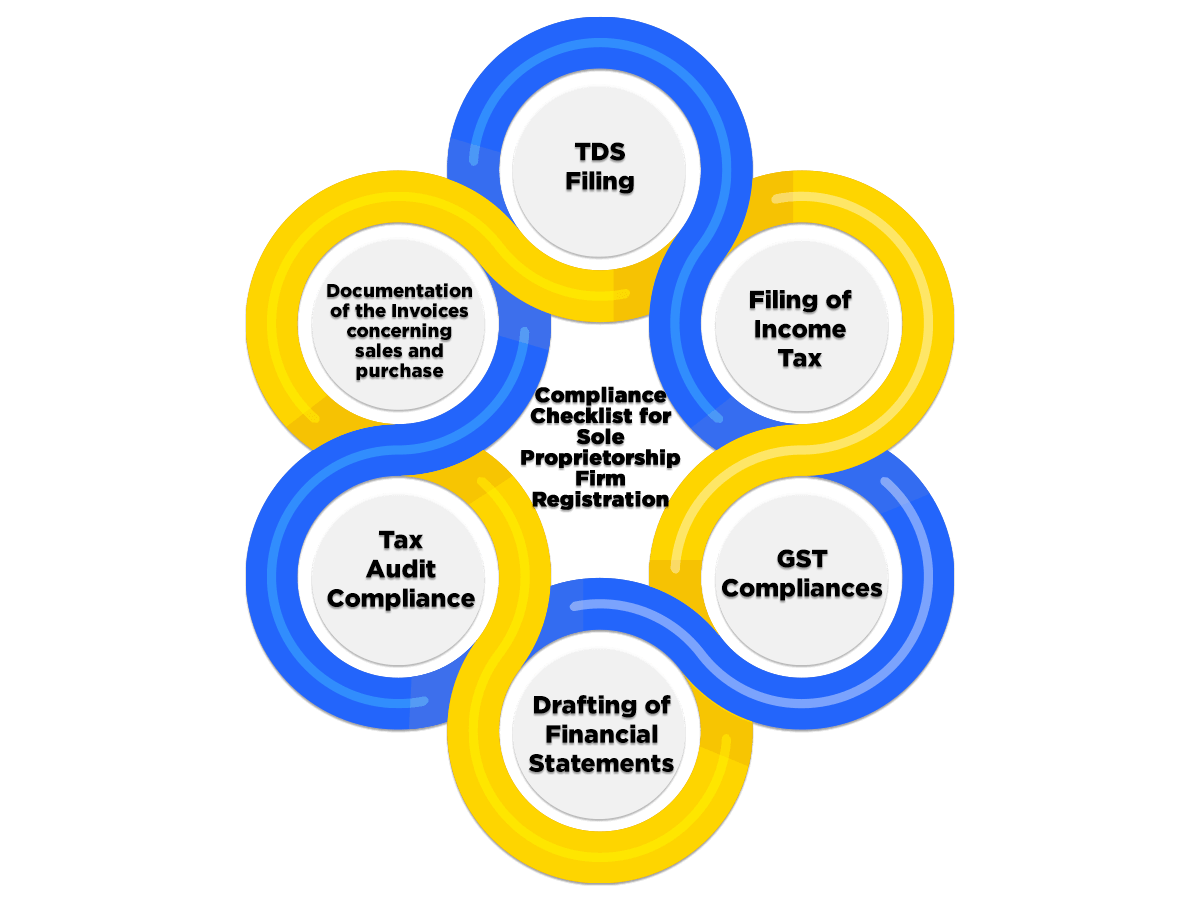

Compliance Checklist for Sole Proprietorship Firm Registration

The that are must exist complied with after obtaining sole proprietorship registration are every bit follows:

- TDS (Revenue enhancement Deducted at Source) Filing

- Filing of Income Tax Render (ITR)

- GST (Goods and Service Tax) Compliances

- Drafting of Financial Statements

- Taxation Audit Compliance

- Documentation of the Invoices apropos sales and purchase

Why Choose Swarit Advisors?

- Swarit Advisors provides terminate to finish assistance regarding the registration process.

- While assisting in the process of registration, we volition fill up the form on behalf of our client and also aid them in submitting the documents.

- We will keep track of the whole registration process and will continue to guide our clients

- We go along loftier impact communication with our valuable clients and as well promptly reply to them.

- For us, client satisfaction is paramount

- We are committed towards the quality work

- We aid our clients in solving their business issues also ensures continuous networking of the business.

- We provide instant and immediate responses to requests made to us.

- We have a wide range of skilled, professional, and experienced experts who will provide friendly knowledge support, affordable hosting solutions and also ensures a successful online presence.

- We at Swarit Advisors help our clients even with the mail-incorporation compliance requirements.

FAQs of Sole Proprietorship Registration

Does Sole Proprietorship need to be registered?

No, there is no need to go a Sole Proprietorship Firm registered in India. It is completely optional and depends on the discretion of the Sole Proprietor. All the same, banks insist on getting the firm registered if the owner or the sole proprietor intends to open a bank business relationship opened in the name of the concern.

Is GST Registration Mandatory for Sole Proprietorship?

Yes, it is mandatory for the owner of the proprietorship business firm to obtain GST Registration in cases, such as the almanac turnover exceeds the prescribed threshold of Rs xl lakhs and Rs 20 lakhs; Opposite Charge Mechanism; Agents and Input Service Distributor; E-commerce Aggregator; for providing information, database and retrieval services to the person residing exterior India.

What is a Sole Proprietorship Registration?

The term "Sole Proprietorship Registration" ways registering an unregistered business that is owned, controlled, and managed by a single person known as the Sole Proprietor of the business firm.

Can a Sole Proprietor appoint an Employee?

Yes, a sole proprietor has the authorization to appoint an employee. Farther, no upper limit is prescribed on the maximum number of employees that a sole owner can appoint.

Is Proprietor the owner?

Yes, a Sole Proprietor is the owner of the Sole Proprietorship House.

What are the Examples of a Sole Proprietorship Firm?

Small Businesses, such as Grocery stores, Photo Studios, Barbershop, IT consultation services, etc., are the all-time examples of a Sole Proprietorship Firm.

Who gets the Profits from a Sole Proprietorship?

A Sole Proprietor being the business owner has consummate control and authorization over the business operations and is entitled to receive all the profits and gains. However, he is also liable to bear all losses incurred in the business.

What are the Compliances required to be followed afterward obtaining Sole Proprietorship Registration?

The possessor of the business concern needs to satisfy some compliance afterwards obtaining a Sole Proprietorship House Registration. The term compliance includes TDS Return Filing; ITR Filing; GST Return Filing; Drafting of Financial Statements; Tax Inspect; Documentation of Invoices for auction and buy.

What are the advantages of the Sole Proprietorship Firm Registration?

The advantages of a Sole Proprietorship Firm Registration are private investment, ownership, no sharing of profit and loss, fewer compliances, total command and authority over business organization affairs.

How many Sole Proprietorship Firms can an individual open in India?

In Bharat, a sole proprietor can beginning multiple numbers of Sole Proprietorship businesses under his proper name.

What are the Fees involved for Sole proprietorship business firm registration in India?

No statutory fees are involved in the procedure of registration, but the price for obtaining other registrations like GST and MSME is required.

Is a pocket-size allowed to start a sole proprietorship?

No, a minor cannot start a sole proprietorship business in Bharat. But a person who is at least xviii years of age can start a sole proprietorship in Bharat.

Can I pay myself a salary, being the sole proprietorship?

No, a sole possessor is non entitled to pay a salary to himself. However, if he does so, information technology ways he/she is transferring funds from one account to some other.

What is the tax to be paid past the sole proprietors?

A sole proprietorship business organization does not come under the ambit of income taxation as a split legal entity. However, one must report all his/her business income or losses in the personal income tax render.

I desire to employ my name every bit my sole proprietorship, can I do then?

Yeah, one can apply his/her proper noun as the name of the business.

What happens to the belongings when a sole proprietor dies?

A Sole Proprietorship Concern ceases to exist after the expiry of the sole proprietor. Further, all the assets and liabilities of the business get part of the deceased's estate.

Who is a Sole Proprietorship?

A sole proprietorship is a business concern entity that is endemic and run by a unmarried person who is the sole trader or proprietor. In this, at that place is no legal deviation between the business entity and the owner.

How to Register a Sole Proprietorship in India?

In Republic of india, in that location is no specific government registration needed for starting a sole proprietorship business. Still, one can register his sole proprietorship business firm nether the MSME or Shops and Establishments Act.

How to Open up a Current Banking company Account for a Sole Proprietorship in India?

A Sole proprietor can open up the electric current account by submitting required documents such every bit License issued by the Municipal Authorities, Income Tax Returns, VAT/CST document. Certificate granted past the Service Tax/ Professional Tax/ Sales Tax authorities, Certificate granted by the Food and Drug Command Authorities and Indian Medical Council every bit an accost and identity proof.

When to File an Income Tax Return for a sole proprietorship in India?

If a sole proprietor is generating both professional income and income from business then he may go alee filing ITR-three or ITR-iv for the presumptive scheme of Income Taxation.

How can one apply for a PAN card for a sole proprietorship?

A sole proprietor can employ for the PAN (Permanent Account Number) card by filing Class 49.

How to Close the Sole Proprietorship Business in Republic of india?

There is no such stock-still procedure for winding up or closing a sole proprietorship business in Bharat. However, a sole owner needs to inform his employees that he is closing the proprietorship business firm.

How to Change the Name of Sole Proprietorship in India?

The subpoena or modification in the proper noun of the proprietorship business firm is made by giving the public and authorities notice, cancelling or changing DBA, structuring sale agreement, and notifying all the interested parties.

How to Verify Sole Proprietorship in India?

The current bank account opened in the proper name of the Sole Proprietorship Firm volition deed every bit proof of the existence for the firm.

Is conversion sole proprietorship into a private limited visitor?

Yes, ane can convert a sole proprietorship firm into a private limited company by registering it to the Registrar of Companies within thirty days afterwards making an application. All the assets of the sole proprietorship firm will exist transferred to the newly incorporated individual company.

Why Swarit Advisor?

What Our Clients Says

Priti Singh

Medico, India

Swarit Advisors has an excellent team with a unique ability to understand complicated technical aspects of innovations and advise innovators on various IP claims. I'm really very impressed with their expertise and hard work.

five.0

Ms Seema Singh

CFO - Online food Delivery App

I take been pleased with every piece of work Swarit Advisors has done for me. They have always been fulfilling the brief & returning a quality report that shows good value for the customers.

5.0

Mr. Vinay Arora

MD, India

I take worked with Swarit Advisors on various IP projects and am happy with their work quality and their responsiveness. Their client alignment, sincerity towards work and prompt communication is something that keeps me promised that I am going to become the best result. I would be happy to use Swarit Advisors's services again and also recommend others to avail services from them.

v.0

TESTIMONIALS

Latest Manufactures

Articles

-

Hey I'm Neha. Allow's Talk!

Can Trademark Be Registered In The Name Of Sole Proprietor Firm,

Source: https://swaritadvisors.com/sole-proprietorship-registration/

Posted by: hairstonhumothisent.blogspot.com

0 Response to "Can Trademark Be Registered In The Name Of Sole Proprietor Firm"

Post a Comment